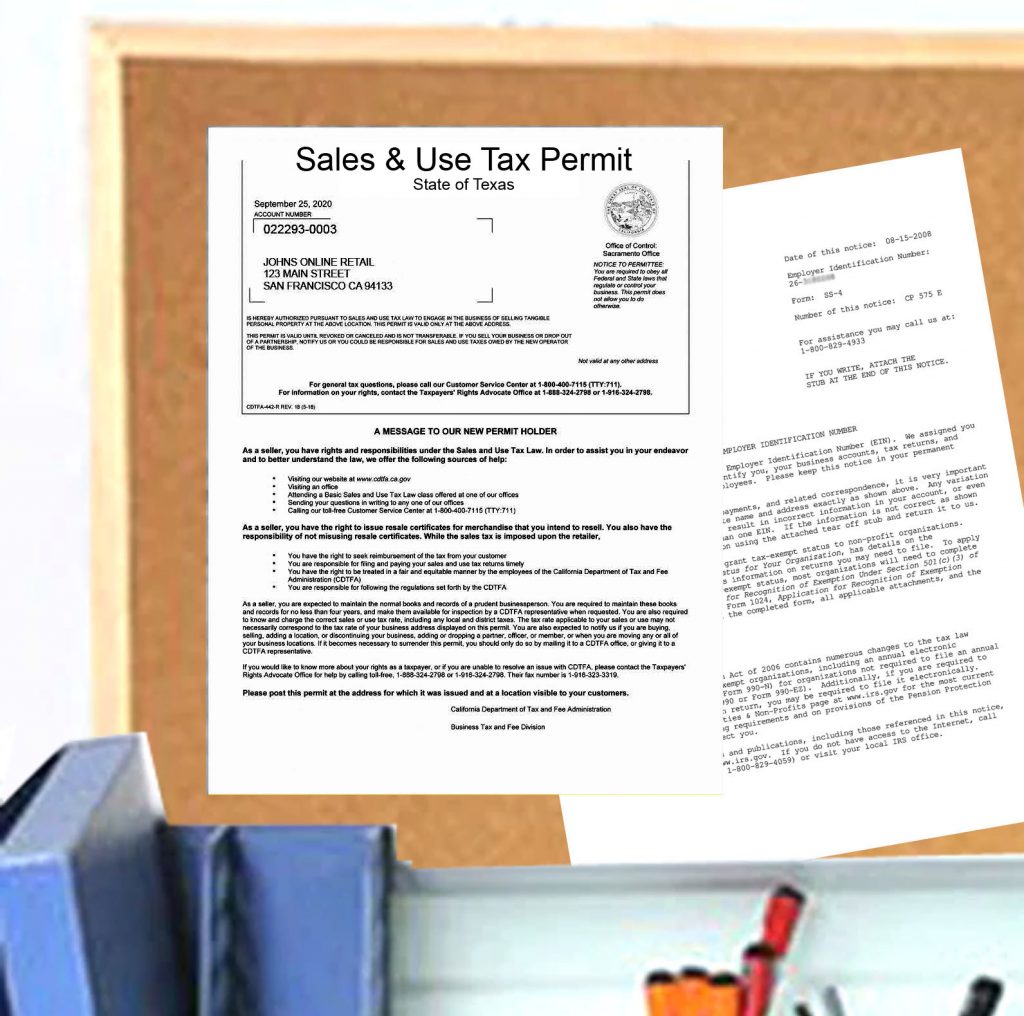

nd sales tax permit

Step 2 Enter the purchasers State of origin and State and Use Tax Permit number. This means that if you are considering opening a new business or are beginning to make sales in North Dakota for the.

Homepage My Back Office Coach Bookkeeping Business Small Business Accounting Small Business Bookkeeping

If you currently have or plan to have employees performing services within North Dakota you should read the Income Tax Withholding Guideline.

. A sales tax permit can be obtained by registering online with the North Dakota Taxpayer Access Point TAP or by mailing in the Sales and Use Tax Permit Application Form. Apply online at the North Dakota Taxpayer Access Point TAP. Ad Skip the Lines Apply Online Today.

North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders. Sales Tax Sellers Permit Simple Online Application. A North Dakota Sales Tax Permit can only be obtained through an authorized government agency.

However a bond may be required. 51 rows Its free to register for a North Dakota sales and use tax permit and a permit remains active until the taxpayer cancels it. Ad Sales Tax Sellers Permit Wholesale License Reseller Permit Businesses Registration.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Any person having nexus in North Dakota and making taxable sales in or making taxable sales having a destination in North Dakota must obtain a North Dakota sales and use tax permit. In North Dakota most businesses are required to have a sales tax permit.

Step 1 Begin by downloading the North Dakota Certificate of Resale Form SFN 21950. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota Sales Tax Application Registration.

This free and secure. The topics addressed within this site will assist you. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

Welcome To The New Business Registration Web Site. The sales tax rate for Bismarck North Dakota when combined with State and County taxes is 7 percent. Where to Register for a North Dakota Sales Tax Permit.

Ad Sales Tax Sellers Permit Wholesale License Reseller Permit Businesses Registration. Any business that sells goods or taxable services within the state of North Dakota to customers located in North Dakota is required to. After reading the guidelines complete the.

There are two ways to register for a sales tax permit in North Dakota either by paper application or via the online. Depending on the type of business where youre doing business and other specific. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021.

Fast Easy and Secure Online Filing. Wednesday January 19 2022 - 1100 am. View more information about the combined state and city rates within the city limits of.

Thank you for selecting the State of North Dakota as the home for your new business. Or file by mail using the North Dakota Application. If you purchase an existing business you must apply for a new sales tax permit as permits are not transferable.

A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit. Sales Tax Sellers Permit Simple Online Application. In the state of North.

Registered users will be able to file and. This is a sales and use tax exemption and refund for machinery or equipment used to produce coal from a new mine in North Dakota. You should apply for a permit 30 days prior to opening for business.

The exemption for each new mine is limited. How do you register for a sales tax permit in North Dakota.

How Airbnbmillionairesecrets Has Generated Over 2 4million In Sales In Under 9 Months Wit Business Ideas Entrepreneur Business Tax Deductions Business Money

Do I Need An Iowa Sales Tax Permit Iowa Small Business Development Centers

Georgia Seller S Permits Ga Business License Filing Quick Easy

How To Register For A Sales Tax Permit In Nevada Taxvalet

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

When To Register For A Sales Tax License Tax Guide Sales Tax Tax

North Dakota Sales Tax Small Business Guide Truic

Sales Tax City Of Fort Collins

What Is A Sales Tax Exemption Certificate And How Do I Get One

You Should Have A Resellers Permit Also Known As A Resale Number Resellers License Or Sales Tax Identification Number If You Have Resale Filing Taxes Sales Tax

Tenant Web Access Lease Agreement Studio Green Tenants

How To Register For A Sales Tax Permit In North Dakota Taxjar

Tennessee Sales Tax Permit Application Startingyourbusiness Com

How To Register For A Sales Tax Permit Taxjar

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate Request Letter Templ Lettering Literal Equations Letter Example

Home Depot Invoice Template 17 Home Depot Receipt Template Application Letter In 17 Receipt Template Business Template Application Letters

Amazon Has Opened New Fulfillment Centers In Four New States Over The Last Couple Of Months Find Out What This Means For Amazon Fba Sellers And Sales Tax